Stripe and Tempo: A New Era for Payments and Stablecoins

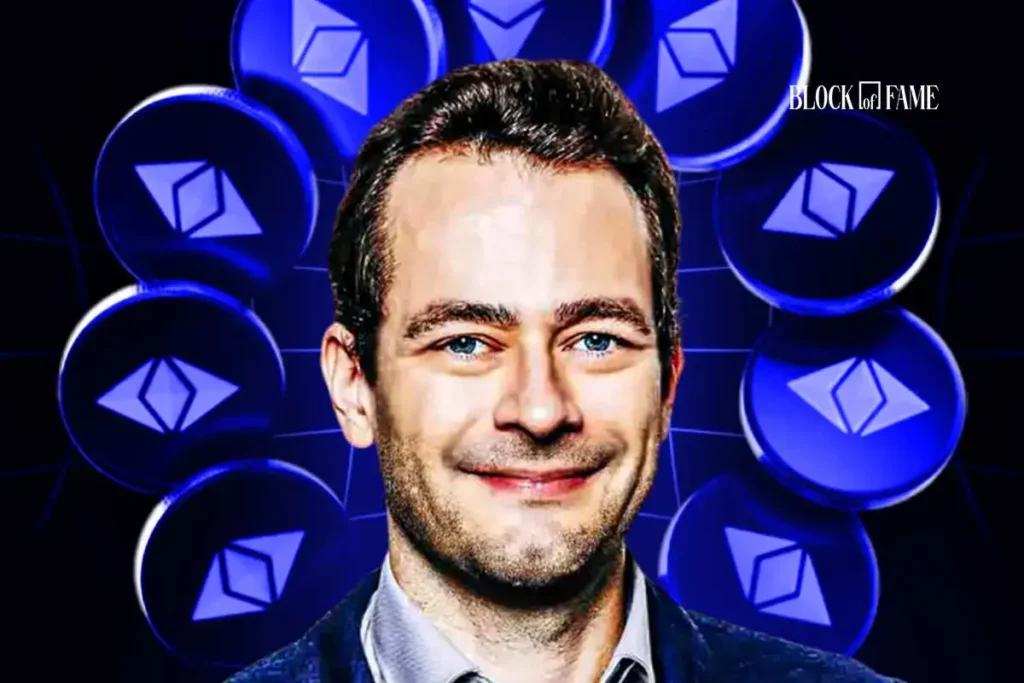

In a strategic move to bolster its technological development, Stripe and Paradigm-backed payments chain Tempo have onboarded Dankrad Feist, a prominent Ethereum researcher. Announced on Friday, Feist’s transition from the Ethereum Foundation to Tempo represents a significant step forward for the payments chain. This decision follows Tempo’s successful Series A funding round, where it raised an impressive $500 million, valuing the company at $5 billion. The backing by high-profile investors like Greenoaks and Thrive Capital signals strong confidence in Tempo’s mission to innovate in scalable blockchain technology tailored for merchant payments.

The Significance of Feist’s Appointment

Feist, a longtime developer recognized for contributions such as Danksharding and consensus research, emphasized his enthusiasm for joining Tempo, framing it as a vital extension of his work towards building high-performance, practical blockchains. Despite his new role, he remains an adviser for various Ethereum research initiatives. His technical expertise is expected to be integral as Tempo seeks to minimize settlement friction and enhance the user experience for stablecoin transactions and merchant flows. Ethereum’s co-founder, Vitalik Buterin, celebrated Feist’s transition, underscoring the critical contributions he has made to Ethereum’s ongoing development.

Tempo’s Vision and Goals

Under the guidance of founder Patrick Collison, Tempo aims to revolutionize transactions involving stablecoins. The mission is centered on creating fast, cost-effective, and reliable solutions for merchants and treasuries. This vision aligns with the broader trend within the industry as stablecoin demand grows, paving the way for innovation in payment mechanisms. As part of its strategy, Tempo has been building an ecosystem of partners, including infrastructure firms like MetaMask and Privy, to enhance its operational capabilities and establish itself alongside competitors such as Solana.

The Growing Landscape of Stablecoin-focused Chains

Tempo is not operating in isolation. As the market for stablecoin-based payment solutions flourishes, several other players are emerging. One noteworthy contender is Circle, which recently launched Arc, a Layer-1 blockchain engineered for stablecoin finance using USDC as its native currency. The focus is on creating an interoperable platform for stablecoin applications. Similarly, Tether’s Plasma project has advanced into its mainnet beta, featuring a substantial liquidity bootstrap and innovative solutions aimed at reducing transfer costs. With these developments, there is a clear trend among chains centered on stablecoin efficiency and low transaction fees.

Navigating Regulatory Frameworks

As Stripe navigates regulatory landscapes, its startup Bridge is actively pursuing a national bank trust charter under the GENIUS Act. This charter would enable Bridge to operate within a unified federal framework, thereby solidifying its status in the evolving financial landscape. Securing such a charter reflects a strategic alignment with the regulatory requirements, emphasizing transparency and security in the rapidly evolving world of cryptocurrencies. The implications for Tempo and other associated projects could be profound, allowing for enhanced compliance and broader adoption.

Conclusion: Future Prospects for Stripe, Tempo, and the Cryptocurrency Space

The synergy between Stripe and Tempo, paired with the appointment of a seasoned Ethereum researcher like Feist, signifies an exciting future for blockchain and payment innovations. As the demand for stablecoins and decentralized finance solutions expands, the strategic initiatives undertaken by these players will not only reshape the payments landscape but also influence the broader cryptocurrency ecosystem. With competitive forces at play, the focus remains on providing users with efficient, accessible, and cost-effective financial solutions, affirming the relevance of stablecoins in the modern economic framework.

Why Trust This Information

This article is designed with relevance and accuracy at its core. As we recognize the dynamic cryptocurrency landscape, it is essential to depend on reliable sources and insights from experienced analysts within the field. Always conduct your own research before making any investment decisions, as the author or publication cannot be held responsible for any financial losses. Should you come across sponsored content or affiliate links, please note that all advertising partners do not influence our editorial choices.