Sui Token: Market Analysis and Recent Developments

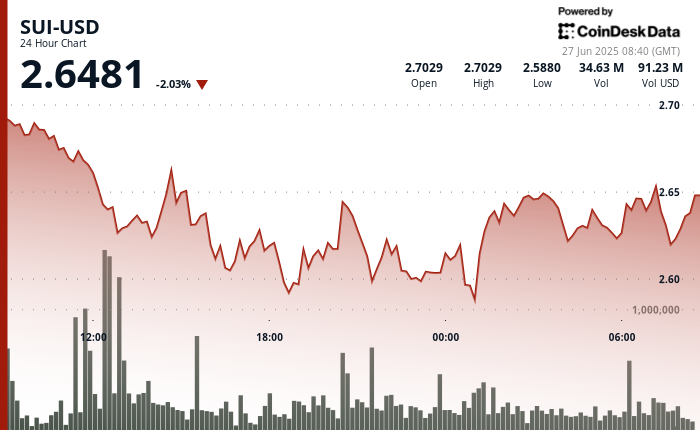

The current trading price for Sui token is $2.6481, marking a 2.03% decrease in the last 24 hours. This decline followed a bounce-back from a support zone between $2.58 and $2.60 during the trading session on June 26–27. Market trends indicate a notable recovery after an intraday drop from $2.70 to $2.58, buoyed by a rise in trading volume and enhanced market sentiment, driven largely by institutional interest.

An important development contributing to the renewed interest in SUI came from Lion Group Holding Ltd. (LGHL). On June 26, the Singapore-based firm announced plans to acquire SUI tokens as part of its $600 million cryptocurrency treasury strategy. In a press release, LGHL stated its initial purchase of 54,000 HYPE tokens for $2 million, at an average price of $37.30 each. This acquisition is part of an overarching strategy, where the company intends to allocate up to 75% of net proceeds from its convertible debenture facility toward acquiring various tokens, including SUI, while the remainder will be utilized for broader cryptocurrency operations and working capital needs.

Lion Group operates a multi-asset trading platform that offers a range of services, including total return swaps (TRS), contracts-for-difference (CFDs), OTC stock options, as well as brokerage for securities and futures. The firm is focused on strengthening its commitment to layer-1 blockchain ecosystems and intends to keep the market informed about future developments of its treasury reserves, which signal a robust confidence in the underlying blockchain technology.

Market activity around Sui has surged, particularly at the $2.60 price level, showcasing significant buying interest that was corroborated by a late-session V-shaped recovery on high trading volumes. However, analysts caution that there remains a resistance level around $2.66, suggesting that short-term price movements could face challenges. Nonetheless, the overall sentiment has shown signs of improvement, indicating a favorable outlook for SUI tokens among traders and investors.

Technical Analysis Overview

Recent technical analysis indicates that SUI exhibited a trading range between $2.58 to $2.70 over the last 24 hours, reflecting a decline of approximately 4.5% from its peak. As of June 26 at 21:00 UTC, SUI stabilized at $2.58, demonstrating accumulation signs indicating potential demand. Several rejection wicks appeared near the $2.66 level, signaling short-term resistance during the trading window from 09:00 to 11:00 UTC on June 27.

Between 07:51 and 08:24 UTC on June 27, a minor bullish reversal pattern emerged, highlighting a recovery from $2.61 to $2.63, during which a sequence of higher lows developed from 01:00 to 08:00 UTC. This evolution in trading patterns is indicative of a gradual shift in market momentum. Notably, trading volume surged 18% above the 24-hour average during the recovery phase that commenced at 08:00 UTC on June 27. This upswing in volume solidifies the support level at $2.60, further encouraging a bullish outlook among traders.

In summary, the Sui token is gaining traction in a volatile cryptocurrency market, with significant institutional interest and recent price action suggesting potential bullish tendencies in the coming sessions. Investors and traders are keeping a watchful eye on market developments, particularly the implications of the Lion Group’s acquisition strategy and broader institutional engagement with blockchain technologies. As always, it’s imperative for traders to stay updated on market trends and institutional movements that could impact SUI’s future performance.

Ultimately, alongside the ongoing technical analysis, the increasingly favorable market sentiment points toward an interesting phase ahead for Sui token in the rapidly evolving cryptocurrency landscape. To make informed trading decisions, constant vigilance on both fundamental developments and technical indicators is essential.