XRP Whale Alert: Analyzing the $55 Million Transfer and Market Dynamics

A recent whale alert involving a staggering $55 million XRP transfer to a Ripple wallet has ignited speculation within the cryptocurrency community. This comes at a time when XRP’s price dipped below $3, despite a generally bullish sentiment prevailing in the wider crypto market. The question on everyone’s mind: Did a significant whale dump XRP into a Ripple-linked wallet amid fears of further price drops?

A Massive XRP Transfer Explained

On October 6, Whale Alert highlighted an impressive transfer of 18,744,800 XRP from an unknown wallet to one associated with Ripple. This transfer, valued at $55,868,599, raised eyebrows within the community. Market participants speculated whether this transfer indicated a forthcoming liquidation or sell-off by Ripple. However, closer investigation into the on-chain data revealed it was simply a transfer between Ripple’s wallets, effectively a housekeeping move within the Ripple ecosystem. This transfer occurred from a wallet that had remained dormant for over two years, sparking questions about its motives.

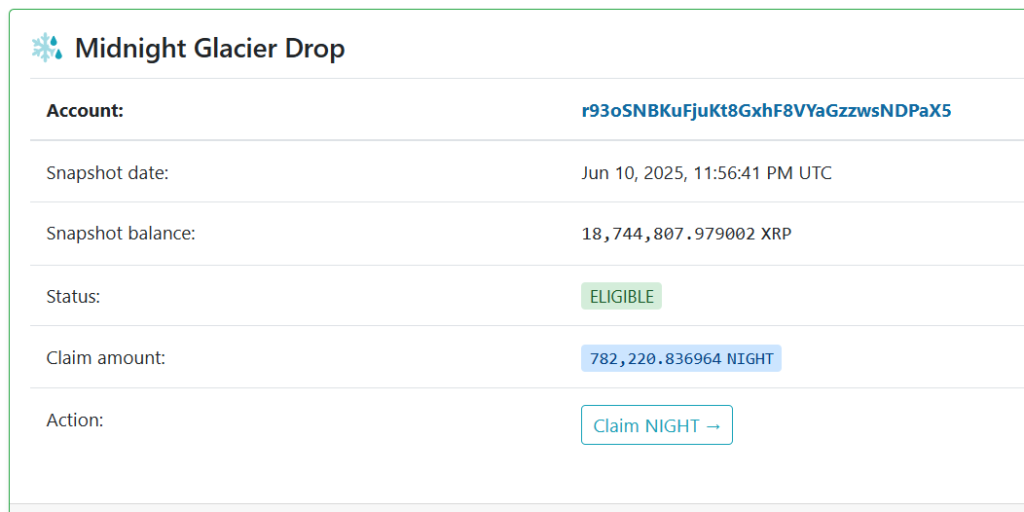

Further analysis using XRPScan provided more insights. Reports indicated that the transfer was connected to a significant cross-chain airdrop conducted by the Midnight Foundation, known as the Midnight Glacier Drop. Ripple received nearly 18,744,807 tokens during this event, highlighting the company’s strategic maneuvering in line with its broader objectives in the crypto landscape.

The Ripple Wallet’s New Holdings and Implications

As a result of the latest transfer, Ripple’s wallet (Ripple 1) now holds a whopping 668,745,081 XRP tokens. This balance includes assets linked to prominent exchanges like Bitstamp and GateHub. The recent inflow of XRP tokens continues to strengthen Ripple’s capital base, allowing the company to maintain robust liquidity and potential leverage in market conditions. Increased holdings in a leading crypto asset like XRP can create strategic opportunities for Ripple as it navigates the evolving regulatory landscape and market dynamics.

XRP’s Price Performance and Market Sentiment

Despite the monumental transfer, XRP’s price action remains tepid, reflecting a critical junction for the asset. Over the past 24 hours, XRP experienced a price decline of 2%, trading at approximately $2.98. The day witnessed trading lows of $2.95 and highs reaching $3.07. The muted price response can be attributed to a lack of significant support from whales and broader market trends. CryptoQuant’s data reveals that the XRP Whale Flow 30-DMA continues to remain negative, indicating that there is a heightened level of selling pressure within the market.

Increased trading volume, which surged by 7% within the same timeframe, does suggest a rising interest among traders. However, it is vital to consider whether this interest will translate into sustained buying pressure or if it is merely a temporary uptick that masks underlying sell-off activity.

Derivative Market Insights and Ongoing Opportunities

Data from CoinGlass indicates a mixed sentiment within the derivatives market, particularly concerning XRP futures. Notably, total XRP futures open interest increased by 0.22% to $8.95 billion over the previous 24 hours. An interesting trend emerged with futures open interest on the CME declining by 1.55%, while a notable increase of 2.66% was observed on Binance. This divergence could potentially indicate a shift in trader sentiment, possibly driven by bullish expectations among Binance users while the CME traders either take profits or adjust their positions in light of recent developments.

Despite current price challenges, analysts remain cautiously optimistic about XRP’s potential to break out of the falling wedge pattern that has developed on daily timeframes. Successful navigation through this pattern could see XRP reclaim the $3.33 level and perhaps rally toward new all-time highs based on the height of the pattern. In this context, the critical support level has been identified at $2.80, which traders should closely monitor.

Conclusion: Navigating the Future of XRP

The recent $55 million XRP transfer to a Ripple-linked wallet has sparked important discussions concerning market behaviors, price movements, and whale dynamics in the cryptocurrency ecosystem. While present challenges have led to price fluctuations, the strategic positioning of Ripple and ongoing interest in the derivatives market suggest that various factors could influence XRP’s trajectory in the coming weeks.

Investors and traders should remain alert to shifts in market sentiment, whale movements, and key technical indicators as they navigate the evolving landscape of XRP and the broader cryptocurrency market. With strategic acquisitions and sophisticated market analysis, XRP has the potential to regain momentum and continue its journey toward recovering previous highs.